capital gains tax changes 2021 uk

This allowance is the amount of money you can earn before you have to pay any income tax. As announced at budget the government will introduce legislation in finance bill 2021 that maintains the current capital gains tax annual.

Capital Gains Tax changes that Self Assessment customers need to know HMRC customers have until 31 January 2021 to declare any profit made from selling a UK residential property which was not.

. Capital gains tax CGT raises close to 10bn a year for the Treasury and last year the chancellor commissioned the Office of Tax Simplification OTS to look at how this tax could be reformed. Landlords should always ensure they meet all legally required deadlines to pay tax. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due.

This was one of the recommendations the OTS had outlined in its report saying the 30-day deadline was challenging for taxpayers. You will no longer be able to defer payment of Capital Gains Tax via your Self Assessment return and any tax owed must be paid within the 30-day reporting and payment period. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely because of the nervousness that the Chancellor would bring CGT more in line with income tax but again this did not materialise.

Related

As announced on 7 September 2021 the government will legislate in Finance Bill 2021-22 to increase the rates of income tax applicable to dividend income by 125. Rumoured changes to Capital Gains Tax havent happened yet but politically it remains a soft target and we consider there to be a relatively high likelihood of reform this autumn or in spring 2022 said Mark Selby National Head of Corporate Finance with Azets the. Although changes to the corporation tax rate were announced there was no increase in the Capital Gains Tax CGT rate however this.

Or The changes will be effective from the new tax year starting 6 April 2021. In the 2021 Autumn Budget Chancellor Rishi Sunak announced that the deadline for people to report and pay the CGT owing from the sale of a property was being immediately increased to 60 days up from 30 days. In 201718 total capital gains tax receipts were 83 billion from 265000 individuals and 06 billion from trusts on total gains of 589 billion.

CAPITAL GAINS TAX and Inheritance Tax changes could be on the horizon for Britons despite the Chancellor failing to make any significant alterations to the levies in yesterdays Budget an expert. Capital tax reform could introduce higher Capital Gains Tax rates over the next few years or alternatively the thresholds. In the Spring 2021 Budget the Chancellor announced a wide range of tax changes for UK property investors with a strong emphasis on encouraging capital spending as a route to achieving recovery in the economy.

For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. Rishi Sunak insists UK will not return to austerity. 0700 Wed Sep 1 2021 UPDATED.

At the moment the allowance is set at 12500 but it is due to rise to 12570 from April this year. Bringing Capital Gains Tax rates more in line with Income Tax could mean a switch to 20 per cent rates for people on the basic rate 40. Landlords need to meet legal deadlines Chris Norris policy director for the National Residential Landlords Association said.

Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed - as of the Budget on 27 October 2021 - this was immediately increased to 60 days. 0704 Wed Sep 1 2021. The current operation of the capital gains tax system is a recognised issue.

Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future years. A total of 16800 of 51300 returns made between 6 April 2020 and 6 January 2021 had failed to meet the deadline according to HMRC. For the 2020 to 2021 tax year the allowance is 12300 which leaves 300 to pay tax on.

Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. Based on the way the government has introduced tax changes in the past there are two likely possibilities. RISHI SUNAK was warned that there are ways for people to avoid paying inheritance tax and capital gains tax as many fear reforms to wealth levies.

The OTS review of CGT published in September suggested four key changes as. In the UK gains made by companies fall under the scope of corporation tax rather than capital gains tax. The changes will be effective from the date of the Budget 3 March 2021.

Currently the standard rate for Capital Gains Tax stands at 10 with a higher rate of 20 18 and 28 for residential property whilst the basic income tax rate is 20 rising to 45 for additional rate taxpayers. Because the combined amount of 20300 is. If a change is announced in the Budget when will the capital gains tax rates go up.

These changes may be significant and have large ramifications for your investments. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Add this to your taxable income.

The dividend ordinary rate will. The annual exempt amount could be reduced from 12300 per annum to between 2000 and 4000 a dramatic decrease This should however be combined with a wider exemption for personal effects taking them out of the charge to CGT A CGT uplift should no longer be applied to assets exempt from IHT and in fact potentially all inherited assets. Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property.

Once again no change to CGT rates was announced which actually came as no surprise.

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Offsetting Overpaid Cgt Against Income Tax Icaew

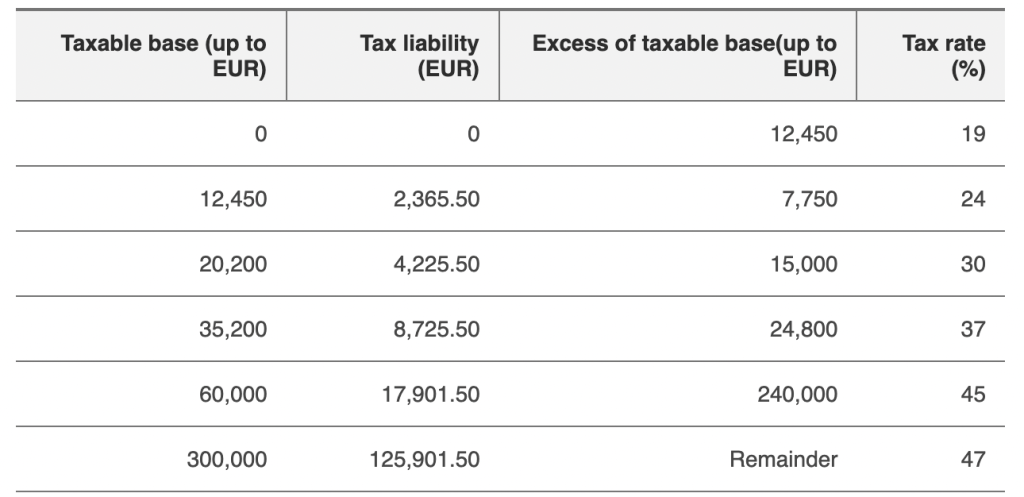

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax Commentary Gov Uk

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Capital Gains Tax In Spain 2022 How Much Do I Have To Pay My Spain Visa

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax What Is It When Do You Pay It

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Difference Between Income Tax And Capital Gains Tax Difference Between

2022 Capital Gains Tax Rates In Europe Tax Foundation

Capital Gains Tax When Selling A Property Robert Holmes

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

3 Capital Gains Tax Retention On Property Sales By Non Residents

Capital Gains Tax Commentary Gov Uk

Capital Gains Tax Relating To Property In Spain Molina Solicitors